18+ Zero down mortgage

The USDA Home Loan Program is a zero down payment required home loan program for those looking for a home in a small town or rural setting. To apply for a mortgage with Vanderbilt follow these steps.

2

Bank of America said it is now offering first-time homebuyers in a select group of cities zero down.

. On the lenders website hover over the Home Loans tab and select Apply for a home loan from the drop-down list. If your goal paying down a mortgage interest-only loans are a bad place to start. But if that borrower makes a 5 percent down payment the fee drops to 165 percent of the loans value.

Bank of America participates in more than 1300 state and local down payment and closing cost assistance programs. In the United States assets particularly real estate whose loans are mortgages with negative equity are often referred to as being underwater and loans and borrowers with negative equity are said to be upside down. Negative equity is a deficit of owners equity occurring when the value of an asset used to secure a loan is less than the outstanding balance on the loan.

Those who qualify can buy with zero down and no mortgage insurance. The fee dips again if borrowers pay down 10 percent or more. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Mortgage Debt Outstanding. Follow the onscreen prompts to provide information about the property.

Bank of America today announced a new zero down payment zero closing cost mortgage solution for first-time homebuyers which will be available in designated markets including certain BlackAfrican American andor Hispanic-Latino. How to apply for a mortgage with Vanderbilt Mortgage and Finance. See the monthly cost on a 250000 mortgage over 15- or 30-years.

Remember the system is designed to keep home prices inflated. Bank of America Real Estate Center site to help homebuyers find properties with flags to identify properties that may qualify for Bank of America grant programs and Community Affordable Loan Solution. Once youve planned your month set a realistic budget.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. As of 2020 theres no max loan amount for VA borrowers. Once a VA loan borrower puts down at least 5 percent down the VA Funding Fee shrinks.

But for the first five to 10 years of the loan the homeowners equity doesnt grow at all unless the owner decides to make extra payments. Practice Budgeting to Zero. Survey of Consumer Finances SCF.

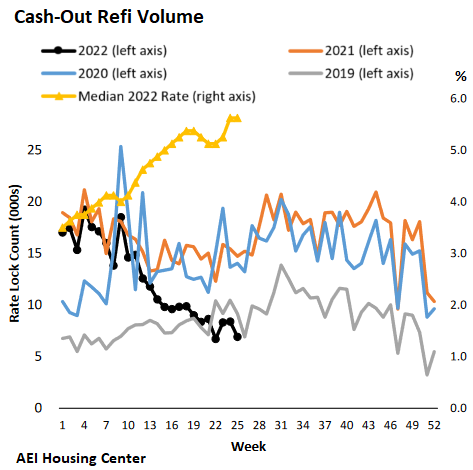

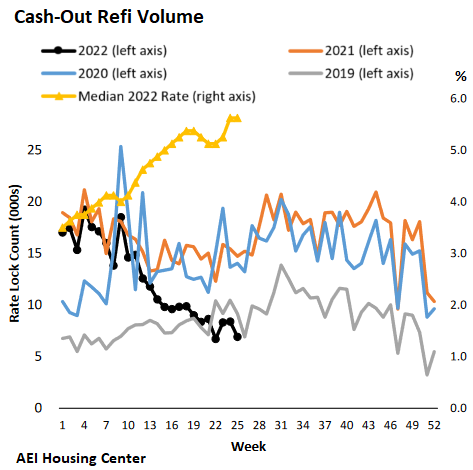

The average mortgage rate for a 30-year fixed is 602 rising 013 from last week and more than 3 from a year ago according to Freddie Macs Primary Mortgage Market Survey. Its important to. So not only do we have 40 plus of homes with no mortgage the nested equity homeowners have now is almost unfair.

Gather the information listed and select Im ready. 18-Year-Old Self-Confessed Crips Member Arrested for Issuing Terroristic Threats to Kill White People. That possibly makes VA loans the best mortgage program out there.

Theres an 8000 down payment mortgage grant available for folks in the Raeford Aberdeen Angier areas of NC that carries no payment and accrues no interest. And particularly so since late 2008 when the FOMC established a near-zero target range for the federal funds rate. For a first-time VA loan borrower the funding fee is typically 23 percent with no money down.

Budgeting to zero means tracking every dollar you earn and giving it a place in your budget until you dont have a single dollar to spare. Interest-only mortgages today generally require large down payments so lenders have collateral against default. Use our app to break down your income necessary expenses extra expenses and your savings contributions.

August 18 2022 1035 AM. The rate on the 30-year fixed mortgage hit 602 this week according to Freddie Mac. Compare and see which option is better for you after interest fees and rates.

Conventional 97 mortgage A Conventional 97 mortgage is another GSE-backed program available from Fannie Mae and Freddie Mac that only requires a 3 percent down payment. From the end of 2008 through October 2014 the Federal Reserve greatly expanded its holding of longer-term securities through open market purchases with the goal of. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Under the new FHA mortgage insurance rules when you use a 30-year fixed rate FHA mortgage and make a down payment of 35 percent your FHA mortgage insurance premium MIP is 085 annually.

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What C Loans For Bad Credit Bad Credit Mortgage Credit Score

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Buying First Home Real Estate Infographic Real Estate Tips

Struggling To Pay Off Mortgage Faster Any Reason To R Personalfinance

Kentucky Usda Rural Housing Loans 100 Financing Home Loans In Kentucky Mortgage Loans Home Loans First Time Home Buyers

How Much Of A House Do You Typically Own After 10 Years Of A Traditional Fixed 30 Year Mortgage Quora

Cash Out Refis With Holy Moly Mortgage Rates For Remodeling Projects Professional Home Remodelers Face New Challenges Wolf Street

2

Learn About No Money Down Mortgages 101 Housing Advice

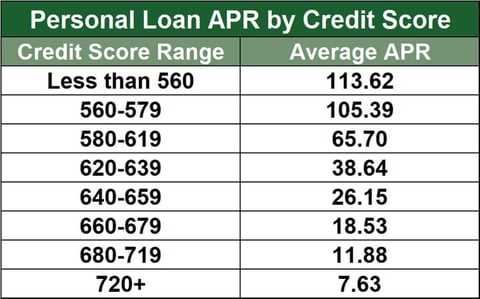

16 Best Interest Rates For Bad Credit 2022 Badcredit Org

Cms Mortgage Solutions Mortgagecms Twitter

Infographic Down Payment Requirements Lender411 Com Mortgage Loans Mortgage Lenders Real Estate Infographic

Mortgage Introducer July 2022 By Key Media Issuu

Cms Mortgage Solutions Mortgagecms Twitter

2

Affordability Page 2 Of 7 Realtor Com Economic Research

Are You Ready For Homeownership These Zero To Low Down Payment Loans Are Awaiting You Follow Nawlinsrealtor Pond Home Ownership The Borrowers Down Payment

Louisville Kentucky First Time Home Buyer Programs And Resources Real Estate Infographic First Time Home Buyers Mortgage Loans